Not Much Ado About Something?

Not long ago, my mornings began with a familiar routine: log into Bloomberg before brushing my teeth, and hope for a screen of mostly green and yellow text. The days when I woke up to a sea of red were always challenging, especially during the last 3.5 years as tech IPO volumes dried up. The last few months were particularly exhausting as global markets seemed to be in perpetual turmoil, shutting down the much-anticipated IPO market re-awakening.

Now two weeks removed from my old life, a refreshing change has been waking up and feeling compelled to immediately absorb the latest macro headlines. It’s wonderfully liberating not to care about the news and numbers that used to dictate the pulse of the rest of my day!

But what fascinated me this week is that I didn’t appear to be the only one of that mind set. Let’s consider these headlines from last week:

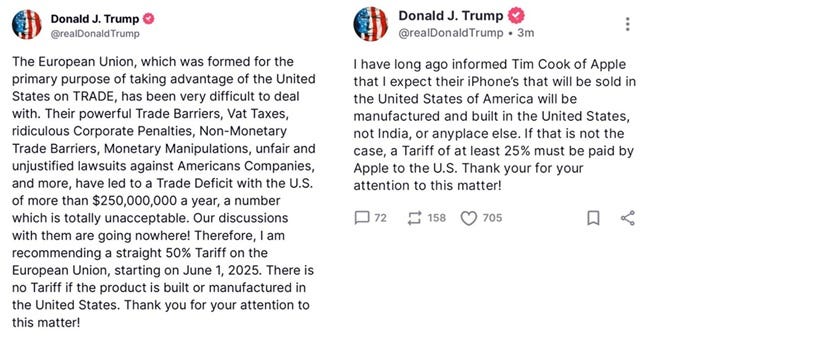

No tariff deals signed, but instead a double-barreled shotgun fired:

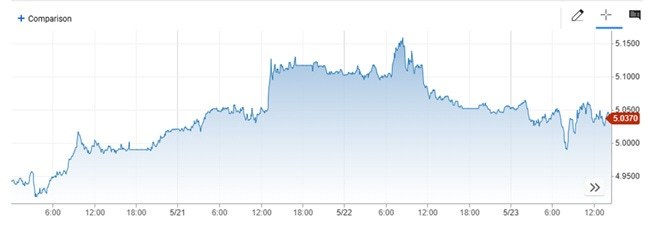

A weak 20-year Treasury auction on Wednesday that spiked yields higher:

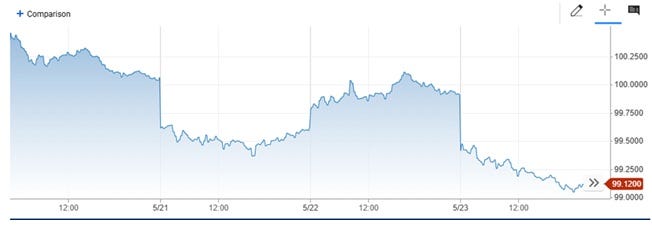

The dollar sliding to a multi-year low versus other currencies:

Prompting a most unintentionally comic quote from Treasury Secretary Bessent, “I wouldn’t necessarily characterize it as a weak dollar. I think a lot of this is other countries’ currencies strengthening as opposed to the dollar weakening.” As my astute teenage son said, “Dad, that’s like saying my side of the see-saw isn’t going lower, your side is going higher!”

A proposed tax bill passed the House that potentially increases the federal deficit by $4-5 trillion over the next two years!

If you told me all this would hit in a single week, I would’ve confidently predicted a 4-5% drop in equities. Instead, the NASDAQ only dipped 2.5% as morning sell-offs gave way to mid-day rallies and investors mostly shrugged. Perhaps we’ve all just adapted to the Trump-era whiplash? In that vein, maybe the headlines were tame by 2025 standards as tariffing the EU at 50% is probably not great but still a lot better than the escalating tariff war with China from April that resulted in peak 135% reciprocal tariffs.

And although the VIX did creep above 20 again, no alarm bells rang. In an especially encouraging development, the Tech IPO market continued the momentum from eToro as two smaller-cap (!) IPOs priced. Hinge Health ($2.6bn EV) and MNTN ($1.5bn EV) both priced at the high end of the range and closed the first day +17%/+65% , respectively. I’ve long pounded the table on institutional appetite for small-cap IPOs and kudos to both companies for being pragmatic about valuation (mid-single digit revenue multiples) and not getting hung up on past round valuations. Best of luck to both as they embark on their journeys as public companies!

But what does that journey look like for the foreseeable future? This is where it gets difficult. The policy news cycle has slowed down but is still very active. The 90-day tariff pause has thus far mitigated any supply chain issues/inflationary pressures, but no trade deals have been signed yet. The consumer seems to be hanging on (as it has for a few years now) although recent news from Klarna’s BNPL customers struggling to repay loans might be a canary in the coal mine. It’s also tough to know how much of the surprising market strength is being driven by retail versus true institutional support because the signs of froth are beginning to emerge:

Palantir trades at a 100x LTM revenue multiple after a 70% rally from the April bottom and now sports a $291 billion market cap.

GameStop, our favorite meme stock, surged this week to close at its highest share price since the end of 2022.

Noted, uh, financial newsletter writer Anthony Pompliano announced the launch of his $250mm SPAC. I suggest he name it IPO O as homage to the last cycle. IYKYK.

Robinhood announced a 26% surge in April trading volumes versus March, as retail massively bought the dip.

I can’t wrap my head around what’s driving the markets and have so many questions. Are institutional investors, many of whom sold the April bottom, only to miss the full rally back, FOMOing into equities or are they selling into a retail-fueled rally? Are retail investors YOLOing the markets again, not because of surplus savings as in 2021, but because they’re running out of money and see no other way out? Is the Administration playing markets like a yo-yo, pushing its policy agenda to the point of market exhaustion before snapping it back with bullish comments, and now pushing again given the equity price cushion that’s been built in May? What are companies seeing in their businesses and are investors turning a blind eye to potential bad news during Q2 earnings season? Finally, is a weakening dollar helping to prop U.S. equities in the short-term?

Those who know me know that I’ve never shied away from taking a view, but the honest truth is I have no idea where markets go from here.